HOW IT WORKS

Tech that

democratizes

MBS trading

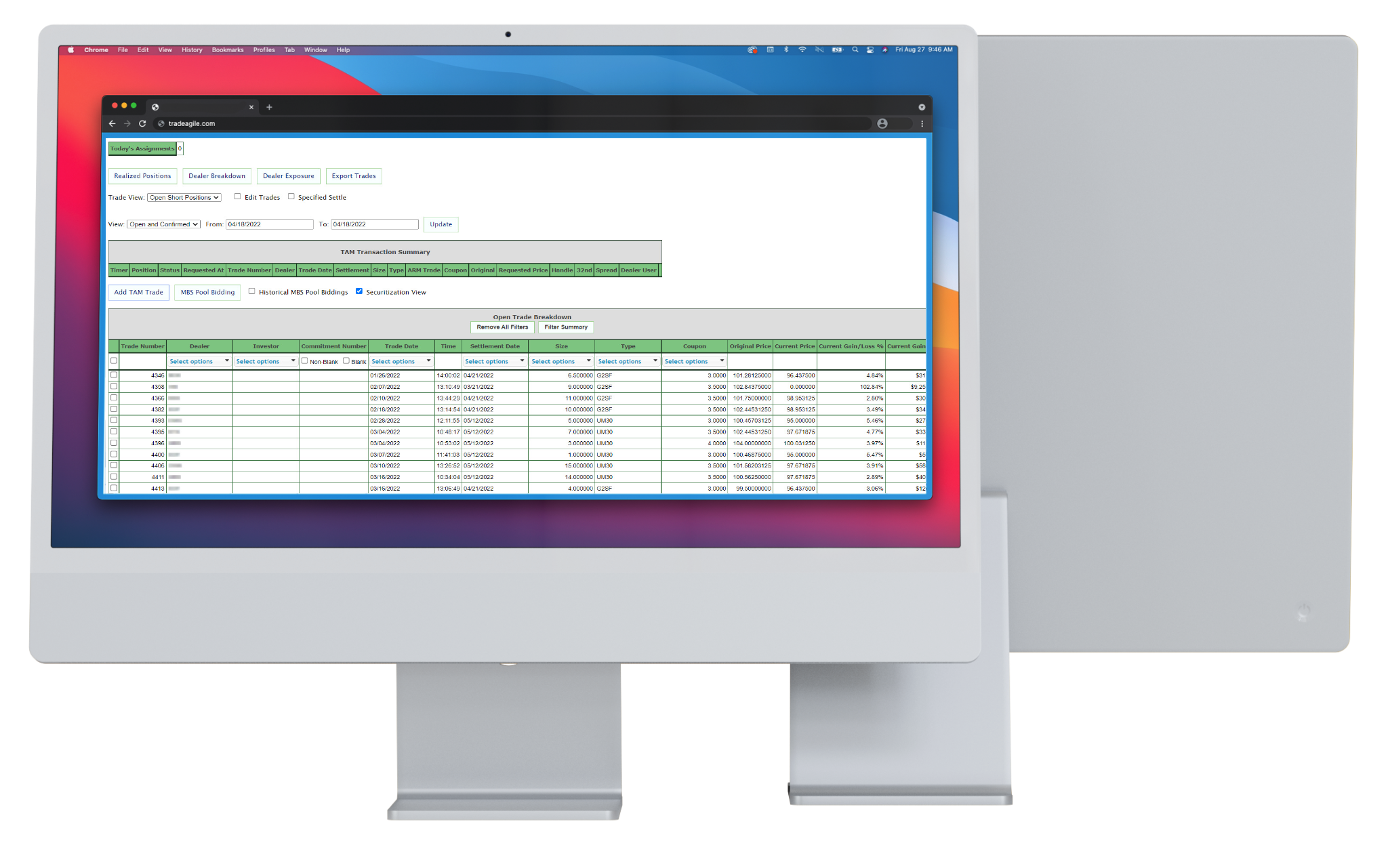

Agile overturns manual processes to unlock the potential of an electronic marketplace.

Agile digitizes the historically phone-based communication process to support both TBA trading and MBS pooling.

Because Agile is a browser-based and app based platform, lenders can request trades from any device, anywhere.