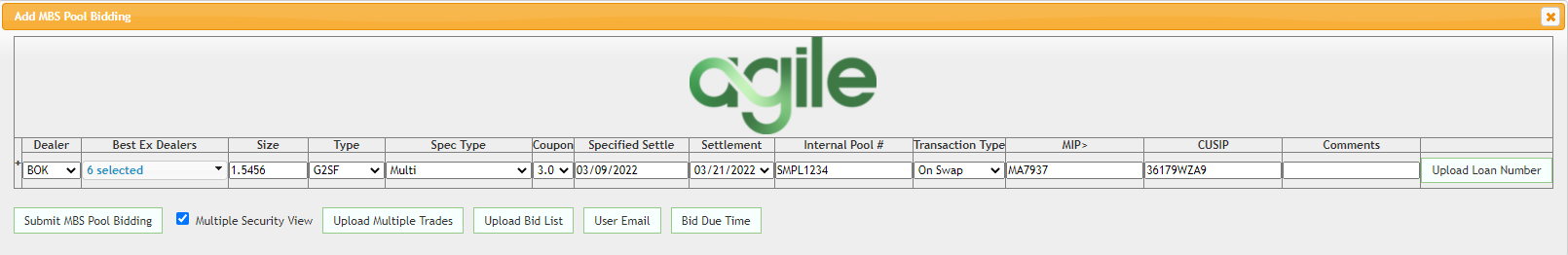

Our MBS pool bidding enables lenders and dealers to gain much-needed efficiencies and data through technology. As securitization rates increase, an increasing number of lenders may be exploring specified pools for the first time. We launched MBS pool bidding to help bring lenders and dealers together more seamlessly, offering both user-friendly technology and a supportive client experience.

Agile wants to streamline the clunky process of spreadsheets, emails, non-standard protocols and data sets. This functionality was designed to facilitate the pool bidding process. Now, we’re helping you find the best ex for pools.

From Agile CTO, Phil Rasori

“Before this release, most clients conducted the spec pool bidding process via email and spreadsheets. Lenders send out pool details to their approved dealers and bids are sent back via email. This process is effective but not efficient.”

From Agile CTO,

Phil Rasori

“Before this release, most clients conducted the spec pool bidding process via email and spreadsheets. Lenders send out pool details to their approved dealers and bids are sent back via email. This process is effective but not efficient.”

Agile’s MBS pool bidding offering includes:

Matt is an industry veteran with ten years of experience trading mortgage=backed securities as an agency MBS trader at StoneX.

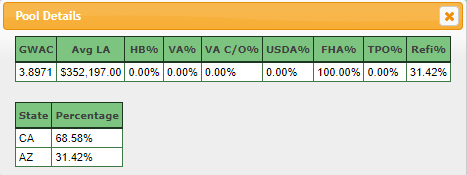

We believe that a transparent market is a better market, for all industry participants. This is why we’ve created a revolutionary electronic MBS platform that brings together mortgage lenders and broker-dealers of all sizes.

Because every counterparty deserves access to a fair, efficient and transparent marketplace.