Agile has already received strong participation from the broker-dealer community, thanks to new opportunities for growth and operational improvement. Agile’s initial rollout began January 1, 2021 and demonstrated rapid adoption across the mortgage secondary market. Agile has supported 300+ financial institutions who have exchanged 95.6 thousand quotes.

From Agile CEO, Curtis Richins

“Our mission is to bring the mortgage capital markets into a new digital era.”

“We’re democratizing the TBA Market for lenders and dealers both big and small. We created Agile because we believe that a transparent market is a better market and because every counterparty deserves access to a fair, efficient and transparent marketplace.”

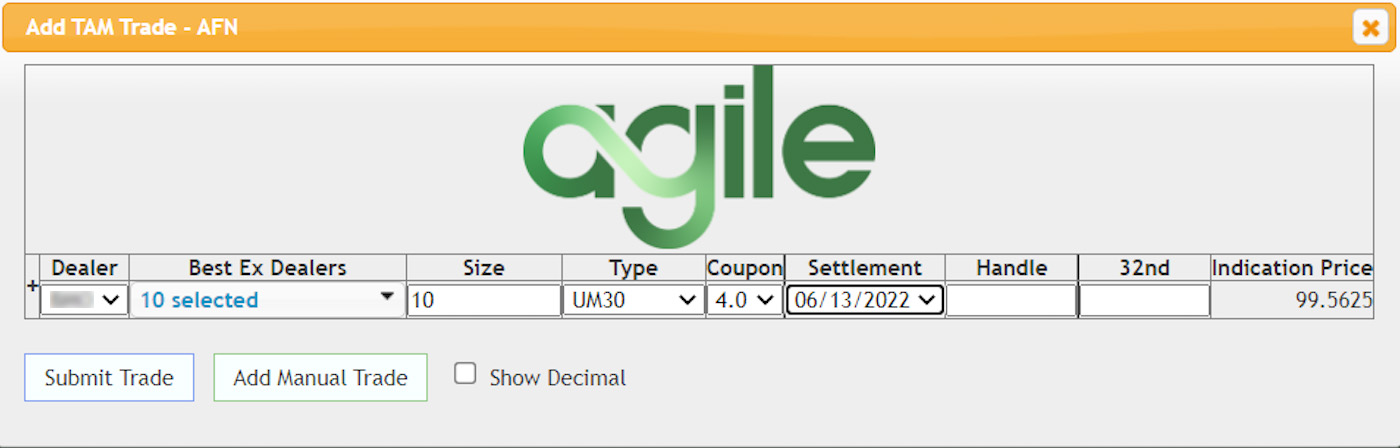

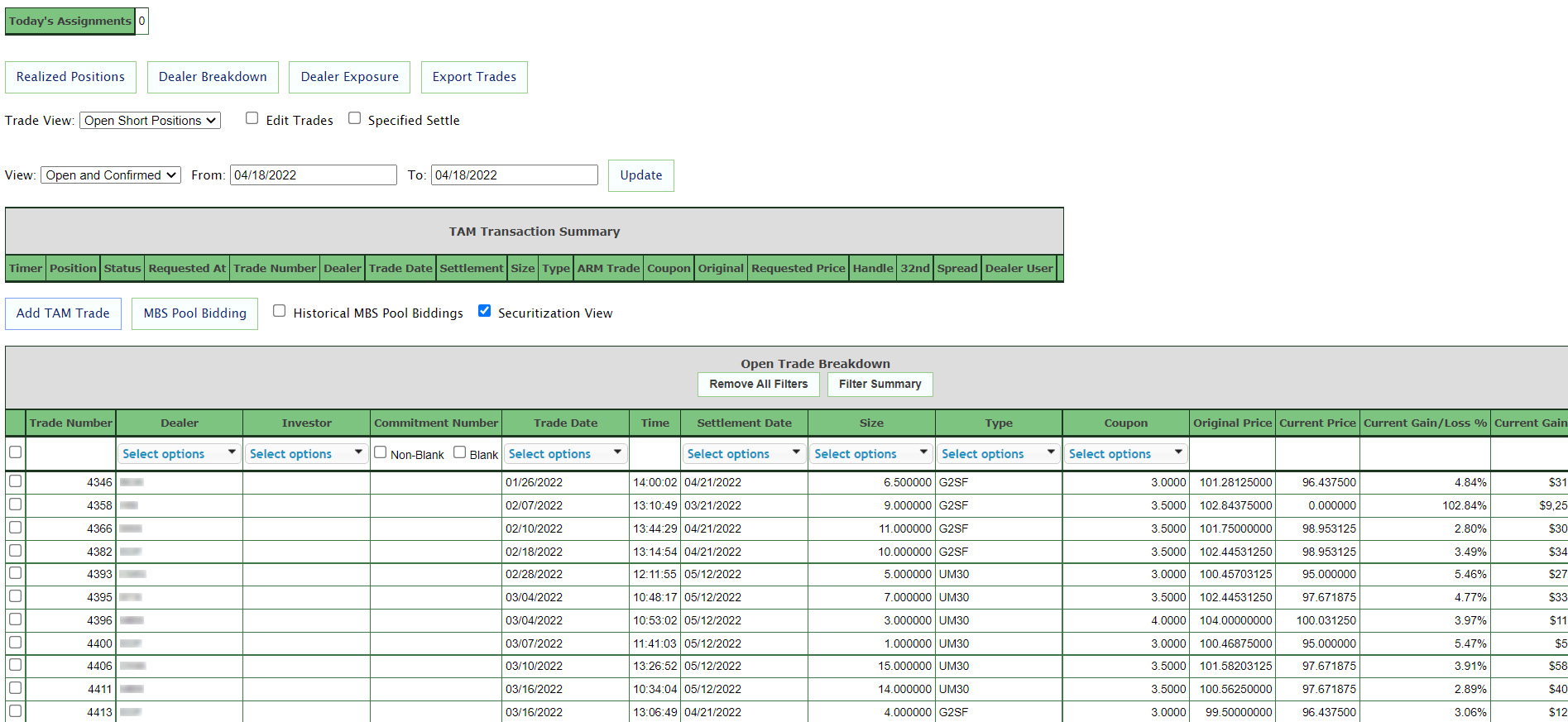

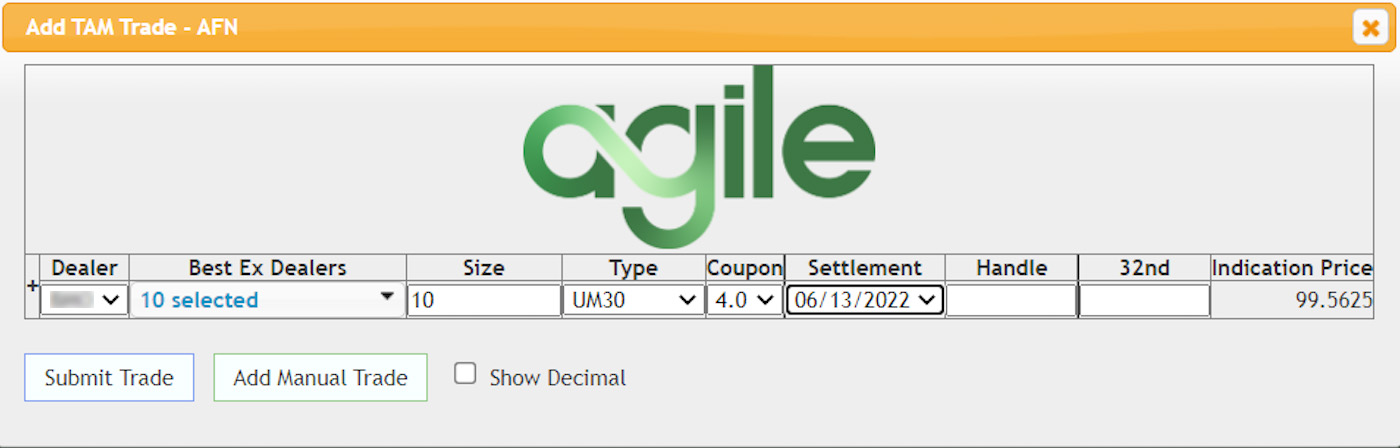

Agile enables the user to efficiently generate more competitive bids compared to legacy phone-based processes. This powerful platform integrates smoothly with existing processes. Lenders can request trades from any device, anywhere.

As Agile builds on its mission to digitize TBA MBS trading, the addition of messaging functionality on our electronic MBS platform has been designed to help close the gap between trading counterparties and encourage a sense of

community.

Agile Chat helps lenders and dealers to…

Brent Giese,

Executive Director of Fixed Income

Daiwa Capital Markets America

“Working with Agile has been very productive and beneficial to Daiwa’s growing mortgage banking sales franchise. With access to many qualified mortgage originators, the platform provides an efficient means to reach significant volumes. The technology is advanced and allows for effective performance feedback while their straight though processing capability eliminates costly trade errors. Simply put, I have been very impressed and am thankful to have this valued partnership.”

Brent Giese is an Executive Director with Daiwa Capital Markets. He has over 35 years of professional experience working in capital markets and fixed income.

Brent Giese,

Executive Director of Fixed Income

Daiwa Capital Markets America

“Working with Agile has been very productive and beneficial to Daiwa’s growing mortgage banking sales franchise. With access to many qualified mortgage originators, the platform provides an efficient means to reach significant volumes. The technology is advanced and allows for effective performance feedback while their straight though processing capability eliminates costly trade errors. Simply put, I have been very impressed and am thankful to have this valued partnership.”

Brent Giese is an Executive Director with Daiwa Capital Markets. He has over 35 years of professional experience working in capital markets and fixed income.

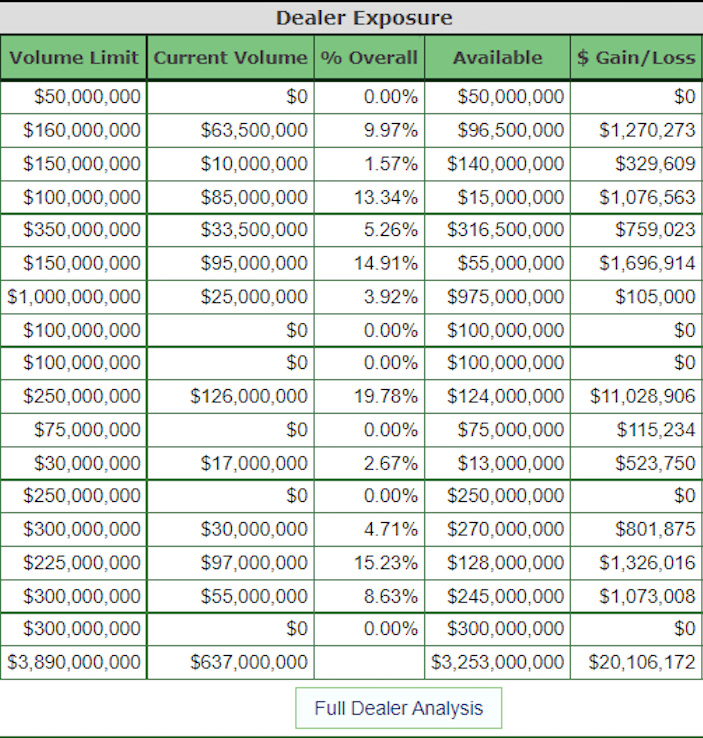

We believe that a transparent market is a better market, for all industry participants. This is why we’ve created a revolutionary electronic MBS platform that brings together mortgage lenders and broker-dealers of all sizes.

Because every counterparty deserves access to a fair, efficient and transparent marketplace.