Agile’s industry-first technology automates the bid tape assignment-of-trade (AOT) between the mortgage originator, mortgage investor, and broker dealer – transferring loan collateral and hedge positions to a mortgage investor.

Agile’s new AOT process replaces the manual and error-prone legacy work practices used by many broker dealers and mortgage investors. Now, with all parties operating on the Agile trades database of record, a more seamless assignment process is enabled. Dealer to dealer assignments are also electronically executed on Agile.

From Brandon Knudson, VP of National Correspondent Sales at Village Capital.

“Village Capital is always looking for ways to integrate technology to improve the price and efficiency for our lenders. Agile’s full automation of the AOT process allows us to pass along improved execution to our customers as well as improve the efficiency of processing the AOT’s.”

“Since everyone is using the same database of record, it greatly reduces any potential errors and speeds up the process of acceptance.”

From Agile CTO,

Phil Rasori

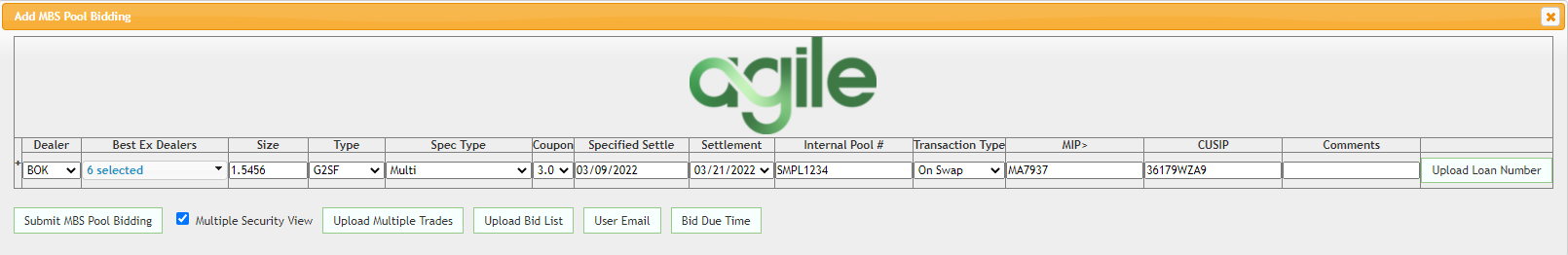

“Before this release, most clients conducted the spec pool bidding process via email and spreadsheets. Lenders send out pool details to their approved dealers and bids are sent back via email. This process is effective but not efficient.”

Automated execution of lender-generated tri-party agreements

Trade blotter for tracking and managing assigned trades

Centralized database of record increases confidence in data integrity

Thomas C. McHugh

Managing Director, Head of Mortgage Group at Cohen & Company

“The Agile electronic trading platform has been a “game changer” for our firm’s daily overall TBA trading activities. The timeliness and effectiveness of Agile’s AOT automation solution has significantly impacted how our traders communicate and execute for our clients. From a back-office vantage point, the Agile system’s ease of implementation and straight-through trade processing has made this a seamless integration into our firm’s daily processes.”