Executive Summary

The emergence of competitive electronic bidding for the fourth month in the To-Be-Announced mortgage-backed securities (TBA) market represents a significant evolution in trading of off screen securities. This blog delves into the benefits this innovation brings, particularly in terms of transparency, efficiency, and execution. While Agile’s immediate focus is on fourth month trading, this initiative also serves as a preliminary exploration into the broader potential of electronic trading for other off screen TBA securities.

Traditionally, major TBA trading technologies have provided screen pricing for three settlement months: the front, mid, and back months. Transactions outside of these standard months, such as the fourth month, have been infrequent by comparison. The absence of a ticker for fourth month trades has led to a lack of definitive price transparency. Traders have had to rely on a combination of roll cost calculations in standard settlements and alternative methods to determine whether the prices they are receiving are equitable.

To improve transparency for fourth-month securities, Agile has introduced competitive electronic bidding for the fourth month. While the fourth month still lacks a ticker, traders can now access pricing on these securities from multiple dealers simultaneously. This development promotes a better understanding of where fourth month securities are trading and enables more informed decisions on whether they are priced attractively relative to standard TBA security settlements.

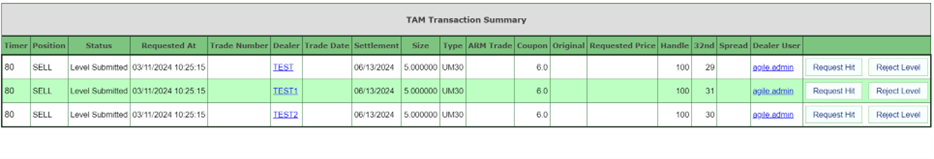

Example of Fourth Month Trade in Agile

The addition of electronic bidding for fourth month securities ushers in a new era of efficiency. Extending trade settlements an additional month can reduce the frequency of rolls necessary to maintain an aggregate hedge position.

To put this into perspective, let’s consider a scenario where a hedge position must be maintained for a year. If one were to use three-month rolls, it would require four rolls over the course of the year to keep the position intact. Conversely, with four-month rolls, only three rolls would be necessary to maintain the position throughout the year.

The reduction in the frequency of transactions has the potential to increase efficiency and lower hedging costs, as each buy, sell, and roll incurs a cost.

The Agile platform revolutionizes execution strategies by empowering users to engage in competitive bidding with up to eight dealers concurrently. This approach not only ensures the acquisition of the best available prices in real-time but also centralizes the bidding process on a single platform. Knowing they are in competition, dealers are driven to offer their most competitive levels, creating improved execution outcomes for traders. The example below shows how competitive bids create improved execution.

Example Transaction Summary on Fourth Month Trade

For builders, the ability to secure fourth month TBAs represents a significant advantage. By aligning the rates offered in forward agreements with the prices of fourth month securities, Agile’s platform ensures a higher degree of pricing transparency from the onset of the contract. This enhancement in transparency not only aids in financial planning but also provides builders with a competitive edge by enabling them to solicit bids from multiple dealers, fostering competition and driving better pricing. The same advantages are applicable to mortgage originators who offer long-term interest rate locks.

Are you looking for areas to save on loan pipeline hedge costs? Agile’s whitepaper, How (and How Much) Agile Helps Mortgage Originators Save on Hedging Costs, discusses several ways that mortgage bankers may pick up basis points in gain on sale*, all while saving time and reducing errors.

The introduction of competitive fourth month bidding on Agile represents a significant evolution in the TBA market, effectively addressing longstanding issues pertaining to transparency, efficiency, and execution. By streamlining the trading process and equipping users with previously unavailable tools and capabilities, Agile is setting a new standard in the marketplace. As we look ahead to expanding our offerings, our commitment remains unwavering in delivering continuous innovation and improving the trading experience for all market participants.

Agile is a platform that allows mortgage bankers to solicit multiple quotes for their TBA securities. Agile can improve execution and potentially reduce trading errors due to removal of human error. Mortgage bankers who are interested in improving the efficiency and execution of their TBA trading should consider Agile. Visit trade-agile.com/contact-us/ to get started.

Agile brings together lenders and dealers of all sizes onto a single platform. Agile facilitates the exchange of TBA MBS by securing and automating communication between mortgage lenders and broker-dealers. Agile digitizes the historically phone-based process to an electronic platform which may improve profitability and efficiency, while reducing administrative errors. Through its competitive TBA RFQ digital platform, mortgage lenders gain access to national and regional broker-dealers previously inaccessible on digital platforms, while broker-dealers gain access to an ever-growing network of lenders. Based in Philadelphia, Agile Trading Technologies supports a national network of clients with a team of capital markets professionals who have deep trading experience at financial organizations of every size.

For more information, visit https://trade-agile.com/ or call 619.332.6205.

*Agile is not available for retail natural person investors.

1Andrew Price is a capital markets professional with more than 12 years of experience starting as a secondary marketing trader and growing into his current AVP Capital Markets role.

2Eric Bridges is a VP of Secondary Marketing with more than 10 years of experience working as a secondary marketing professional.

Sam Farmer serves as the Manager of Trading Strategies & Client Support at Agile, a role that underscores his deep expertise in the financial sector and commitment to client success. In this position, Sam leverages his extensive knowledge to develop and implement data-dependent trading strategies, while ensuring superior client support and satisfaction. His proficiency in data analysis on the Agile trading platform has been instrumental in optimizing trading performance and client outcomes. Before joining Agile, Sam served as a Capital Markets Technology Advisor at MCT, where he played a key role in devising and advising on market strategies. His insights and guidance were crucial in navigating complex capital market dynamics. Sam’s career journey, marked by progressive roles in capital markets and trading, reflects his versatile skill set and unwavering dedication to excellence in the financial industry.

We believe that a transparent market is a better market, for all industry participants. This is why we’ve created a revolutionary electronic MBS platform that brings together mortgage lenders and broker-dealers of all sizes.

Because every counterparty deserves access to a fair, efficient and transparent marketplace.